Event budget is the financial plan of an event, bringing together all income and expenses. When budget planning is done carefully, event budgeting stays under control, surprises are minimized, and decisions (e.g. catering level, program, marketing) are based on facts—not guesswork.

In this article, we’ll walk through how to build an event budget step by step, share a practical budget example (100-person event), and show how you can track your budget efficiently.

In this article, you’ll learn:

- Why is it important to create an event budget?

- Creating an event budget: 4 clear steps

- Event budget example: a concise model for a 100-person event

- Budgeting tool: when Excel is no longer enough for event budgeting

- Tips for managing your event budget

- Frequently asked questions about event budgets

Why is it important to create an event budget?

An event budget is important because it helps ensure resources are used wisely and that your event goals are achieved. A well-prepared event budget helps you:

- anticipate and control costs

- avoid unexpected expenses

- track the event’s financial performance

- report on and evaluate event profitability

It’s a good idea to structure your budget planning by separating fixed costs (independent of attendee count) and per-participant costs (that increase as attendance grows). The same logic applies to income, so you can quickly see what impacts the overall result the most.

Creating an event budget: 4 clear steps

- Define objectives

- Estimate income and expenses

- Risk management and contingency planning

- Track and update the budget

1. Define objectives

Creating an event budget starts with the goal: is it a customer event, an internal staff event, or a trade fair participation? Are you aiming for profit, leads, visibility—or staying within a fixed entertainment budget? When the objective is clear and shared with everyone involved, budgeting stays aligned with the right choices.

2. Estimate income and expenses

An event budget consists of income and expenses. Some costs are fixed (e.g. venue rental, performer/speaker), while others are per participant (e.g. catering per person). Income can be per participant (tickets) or fixed (sponsorships).

Income can come from ticket sales, sponsor and partner fees, and product sales during the event.

Typical expenses include, for example:

- Venue: rental, technical equipment

- Marketing and communications: digital marketing, ads, materials

- Catering: food and beverages

- Program and speakers: speaker fees, program production

- Logistics and staff: transportation, staff wages

3. Risk management and contingency planning

An event budget is always an estimate, and you can’t predict everything. That’s why you should include a buffer for unexpected expenses. A good rule of thumb for many events is a 5–10% contingency of total costs—depending on the event size and risk level.

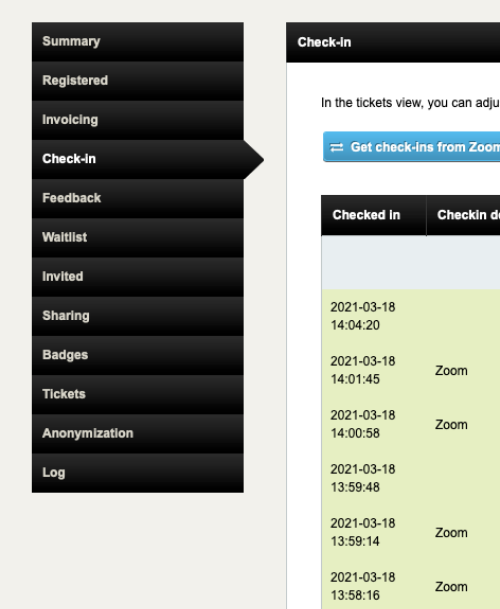

4. Track and update the budget

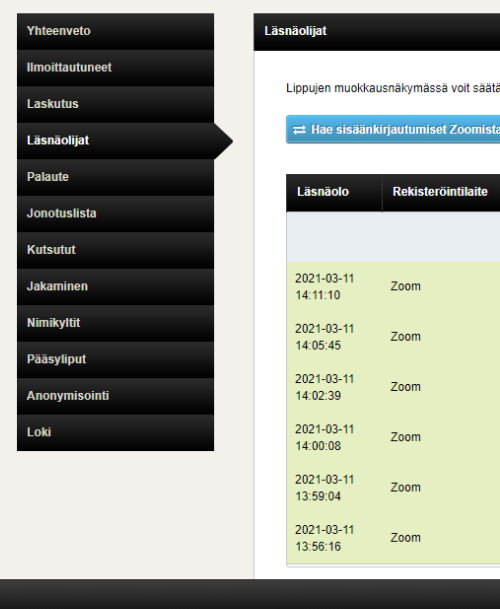

Event budgeting doesn’t end when the first version of the budget is ready. Tracking is an ongoing process: you should monitor cost development, sales, and forecasts throughout the project—especially when attendance or catering volumes change.

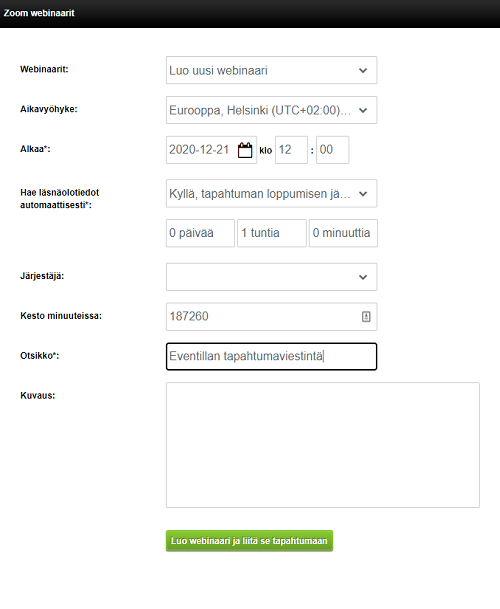

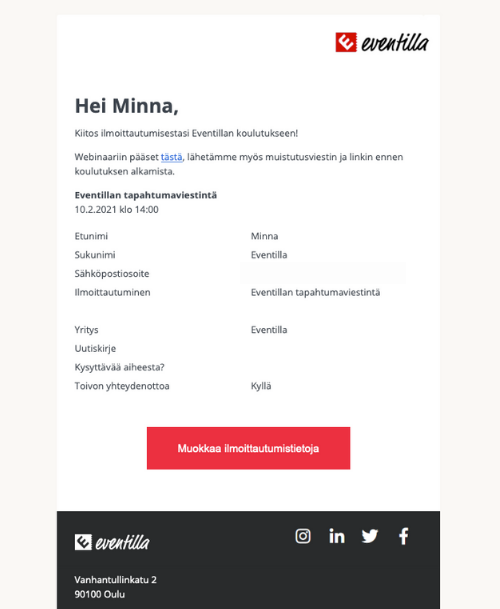

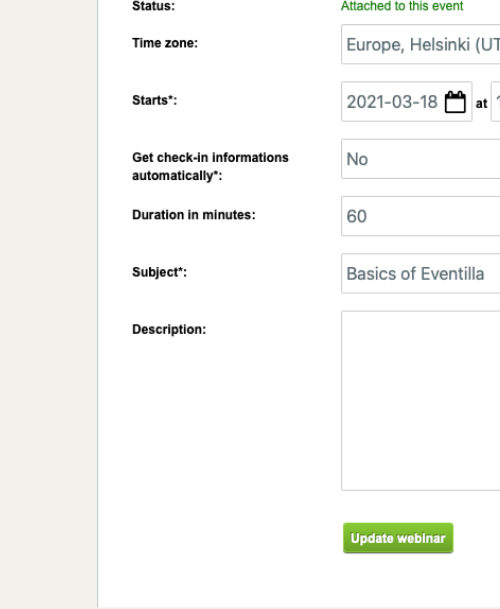

Tracking is easiest with a system built specifically for event budgeting. Eventilla’s budgeting tool lets you follow your event budget in real time directly inside the event management system.

Event budget example: a concise model for a 100-person event

A budget example makes it easier to build your own event budget when you can see the key income, costs, and contingency at a glance. Below is a concise table for a 100-person event—use it as a base and scale it by attendee count.

| Row | Calculation | Amount |

|---|---|---|

| Income | Ticket sales 100 × €39 + sponsorship €1 000 | €4 900 |

| Expenses | Venue €900 + tech €450 + program €600 + catering 100 × €18 + staff €350 + marketing €300 + materials €200 + payment fees €120 | €4 720 |

| Contingency | 7% of expenses | €330 |

| Total expenses | Expenses + contingency | €5 050 |

| Result | Income − total expenses | −€150 |

How to read the budget: If your event budget forecasts a negative result, even a small change can turn things around. In this example, increasing the ticket price by €2 would make the result positive. Additional savings in catering would move the budget clearly into profit.

Budgeting tool: when Excel is no longer enough for event budgeting

A budgeting tool helps you build and track your budget in one place—without manual Excel work. Especially for paid events (tickets, discount codes, ticket types, sales development), the budget changes constantly. A real-time view saves time and reduces errors.

Eventilla’s budgeting tool helps you combine event sales and costs into one view: track the budget in real time, compare planned vs. actual, and understand your income and expense structure at a glance.

Tips for managing your event budget

- Use data from previous events: review actual costs and sales, and update your assumptions realistically.

- Compare suppliers: request quotes from multiple vendors and give the process enough time.

- Break down per-participant costs: catering, materials, and content scale easily—and so does the risk.

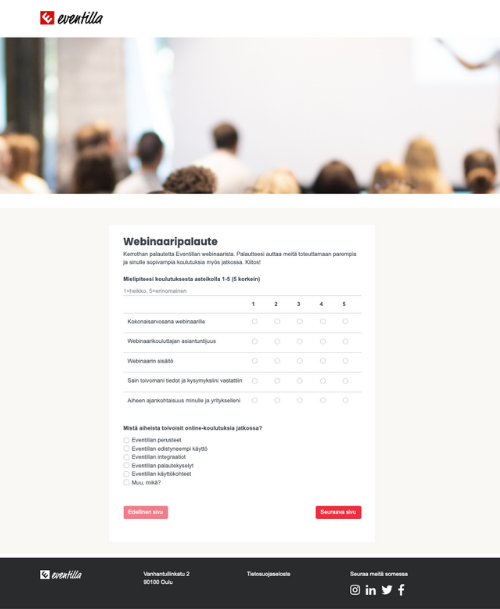

- Measure marketing performance: allocate budget to channels that bring the most registrations or ticket sales.

- Track and report in real time: make your budget a living tool—for example with Eventilla’s budgeting tool.

Careful planning and continuous tracking help keep event costs under control and ensure financial success. Remember: budget planning isn’t just about numbers—it’s strategic planning that supports achieving your event goals.

Still looking for a ticket sales system for your event? Here are the most important features to consider—so you can choose the right one:

Frequently asked questions about event budgets

- How much does an event cost? The event budget depends on the number of participants and your choices (venue, catering, program, technology, marketing). A good starting point is to separate fixed costs and per-participant costs and calculate a “cost per participant”.

- What are hidden event costs? Hidden costs often include extra tech and overtime, cancellation terms, transportation, print materials and decor, payment processing fees, insurance, and small supplies. Always add a 5–10% contingency to your budget.

- How can I create an event budget quickly? Budgeting is faster when you use a ready-made cost category structure (venue, tech, catering, program, marketing, staff, logistics, materials) and mark each line as fixed or per participant. After that, you simply scale by attendee count.

- Should I budget in Excel or use a tool? Excel works for smaller setups, but when you have multiple ticket types, discount codes, and ongoing sales tracking, a budgeting tool saves time and reduces errors. With Eventilla’s budgeting tool, you can follow both budget and sales in the same view.

- What is a good ticket price so the budget works? Calculate total costs (incl. contingency) and divide by a realistic number of participants. Then add your target (e.g. break-even or margin). If you can’t increase the ticket price, look for savings in per-participant costs or grow income through sponsorships.

About the author

Kirjoittajasta